In today’s digital world, starting a career is getting easier and faster. If you’ve ever wanted to become an insurance agent but felt it was too complicated, GroMo has made it simple. With help from Owrbit, you can now start your journey as an insurance agent without dealing with endless paperwork or visiting offices. Everything can be done online, from learning the skills to getting certified—all from the comfort of your home.

GroMo uses the latest technology to make the process of becoming an insurance agent easy. It offers training modules, real-time support, and a huge network of industry experts to help you succeed. Whether you want to become an insurance agent to earn extra income or start a full-time career, this platform gives you all the tools you need.

In this article, we’ll show how GroMo and Owrbit are changing the way people become insurance agents, making it flexible, profitable, and stress-free. It’s time to take charge of your future and start your journey as an insurance agent today!

Introduction to Insurance Agent :

An insurance agent is a professional who helps people protect what matters most to them—whether it’s their health, life, property, or business. They act as a trusted guide, helping clients understand and choose the right insurance policies that suit their specific needs.

Insurance agents work directly with customers, explaining complex terms in simple ways and ensuring they get the best coverage. Their role is essential in offering financial security and peace of mind. Agents may work independently, representing multiple insurance companies, or exclusively for one company.

Becoming an insurance agent is a rewarding career path, offering flexibility, personal growth, and the chance to make a real difference in people’s lives. Whether helping clients secure their future or recover from unforeseen events, insurance agents play a vital role in today’s world.

Understanding GroMo : A Digital Platform for Insurance Agent :

GroMo is a cutting-edge digital platform designed to make becoming an insurance agent simple and accessible for everyone. It eliminates the traditional challenges like lengthy paperwork, in-person visits, and complicated procedures, allowing aspiring agents to start their journey from the comfort of their home.

Here’s how GroMo helps you succeed as an insurance agent:

- Seamless Onboarding: You can easily sign up and complete the process online without hassle.

- Comprehensive Training: GroMo offers user-friendly training modules to help you learn the skills needed to sell insurance effectively.

- Real-Time Support: The platform provides ongoing assistance to answer your questions and guide you at every step.

- Vast Opportunities: With access to multiple insurance products, you can cater to diverse customer needs.

Whether you’re looking to start a full-time career or earn extra income on the side, GroMo gives you the tools and resources to grow. It’s a game-changer for anyone who wants to become an insurance agent in today’s digital era.

Why Choose GroMo for Your Insurance Agency Journey?

If you’re considering becoming an insurance agent, GroMo offers everything you need to succeed. Here’s why it’s the perfect choice:

- Hassle-Free Onboarding:

- Sign up and get started online with no paperwork or office visits.

- Comprehensive Training:

- Easy-to-understand training modules teach you essential skills to excel in the insurance industry.

- Wide Product Range:

- Access multiple insurance products to cater to a diverse client base.

- Real-Time Support:

- Get expert help whenever you need it, from policy guidance to client support.

- Flexibility:

- Work from anywhere and manage your career on your terms.

- Lucrative Earning Potential:

- Earn competitive commissions and grow your income with every policy sold.

- Trusted Network:

- Build credibility with access to top insurance companies and industry experts.

- User-Friendly Technology:

- Simplify your work with GroMo’s intuitive platform and tools.

Key Features of GroMo for Aspiring Insurance Agents :

GroMo offers unique benefits beyond the basics, making it an exceptional platform for aspiring insurance agents:

- AI-Powered Recommendations

- Use intelligent tools to suggest the best policies for your clients based on their specific needs.

- Performance Tracking

- Monitor your sales progress, identify growth areas, and set targets using detailed analytics and dashboards.

- Seamless Integration

- Integrate GroMo with your email and CRM tools to manage leads and follow-ups effortlessly.

- Customizable Marketing Materials

- Access ready-made brochures, templates, and presentations that you can personalize to promote your services.

- Referral Incentive Programs

- Earn extra rewards by introducing others to GroMo’s platform or expanding your network of agents.

- Regular Skill-Upgrading Webinars

- Attend live sessions and webinars hosted by insurance industry experts to stay updated on trends and techniques.

- Client Relationship Management (CRM)

- Keep track of your clients’ policies, renewal dates, and preferences to build long-term relationships.

- Instant Policy Issuance

- Deliver policies to clients quickly with GroMo’s streamlined process, enhancing their trust and satisfaction.

- Localized Language Support

- Reach a wider audience with resources and tools available in regional languages for better communication.

- Community Support Groups

- Join a thriving community of agents to exchange ideas, tips, and experiences for continuous learning and improvement.

Step-by-Step Guide: Registering with GroMo for Becoming Insurance Agent :

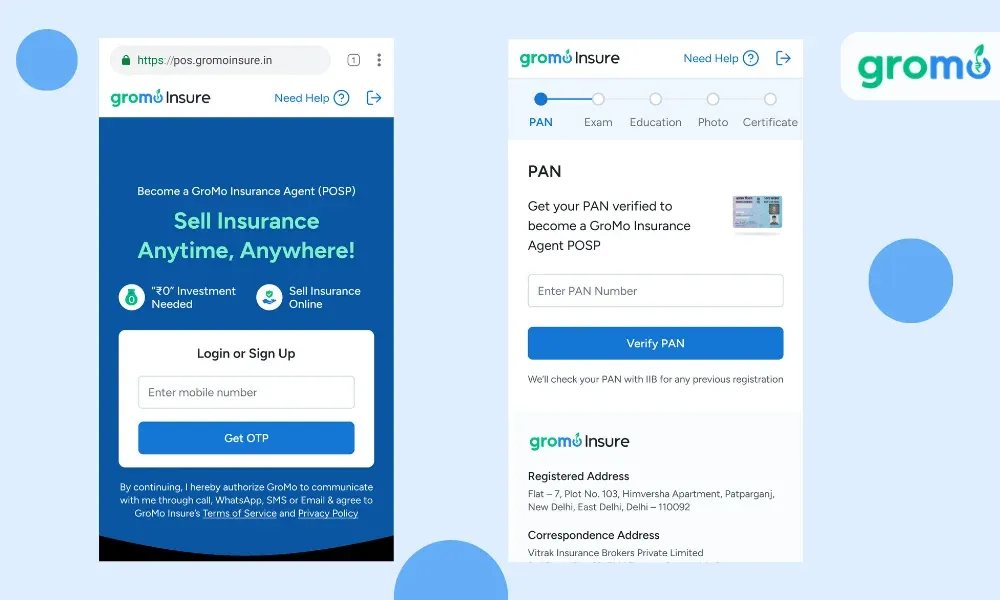

Step 1: Registering As A GroMo Insure Agent

Go to pos.gromoinsure.in and sign up using your mobile number after which you will receive a One Time Password (OTP). Enter the OTP correctly to move to the next step.

Step 2: PAN Card Verification

Once you’ve successfully signed up on the website you will have to provide your Permanent Account Number (PAN) Card details.

Step 3: Personal Details Verification

There are a few personal details (KYC) that are required by IRDAI which are mandatory for a person to provide to become a POS Agent for selling insurance. The personal details include Name, Date Of Birth (DOB), Address, City, Pin code, Email ID and Mobile Number.

You will be allowed to edit your address, Pin Code, and Email ID before submitting the details for verification.

Note that people below the age of 18 years cannot become a GroMo Insure Agent.

So, if you are above the age of 18 years and want to earn a regular income every month by selling insurance products, then check out the GroMo Insure website now.

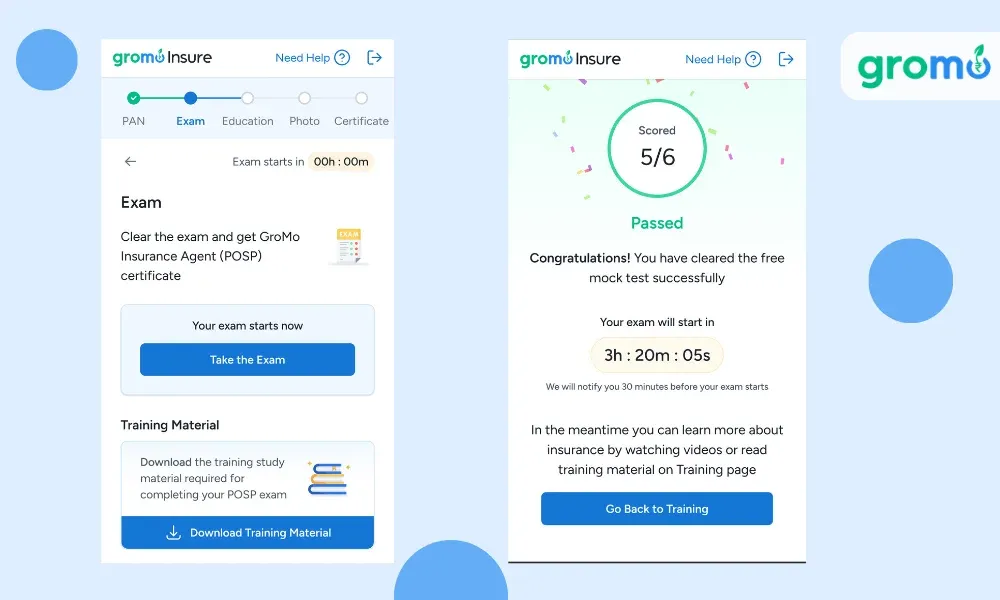

Step 4: GroMo Insure Agent – General Insurance Exam

After you’ve provided all your details, you will be provided with training courses that you will have to complete to take the exam for becoming a GroMo Insure Agent. You will be provided with a total of 15 hours of training material that you’d have to study.

Once you’ve completed this course, you will then be allowed to apply for the General Insurance Agent Exam. The exam will consist of 10 questions.

Step 5: Education Document Verification

Once you’ve cleared the exam, the next step would be to provide your Educational Documents. You are required to submit your 10th marksheet or any other marksheet of higher studies. Once done, you can move to the next step.

Step 6: Photograph Verification

After submitting education documents, you are required to upload your recent passport size photograph.

Step 7: Certificate To Become A POSP

On completion of all the above steps, you are provided a Certificate of a Certified GroMo Insure Agent. You can download the certificate from the home page of GroMo Insure’s website or the GroMo App.

Congratulations! You can start selling insurance as a Certified GroMo Insurance Agent!

Conclusion: Embracing the Future of Insurance Agents with GroMo :

Becoming an insurance agent has never been easier, and GroMo is leading the way in transforming how you can start this rewarding career. With GroMo’s easy-to-use platform, you can quickly become an insurance agent without the stress of paperwork or office visits. The process is entirely online, allowing you to learn, get certified, and begin your career from home.

GroMo provides you with all the tools and support needed to succeed, from comprehensive training to real-time assistance and a wide range of insurance products. Plus, with access to a network of industry experts and innovative technology, you’ll have everything you need to thrive.

So, if you’ve been thinking about how to become an insurance agent, GroMo offers a flexible and profitable path. Whether you’re looking for part-time income or a full-time career, GroMo helps you take control of your future and start your journey as an insurance agent today. It’s time to embrace the future of insurance and turn your aspirations into reality with GroMo!

Discover more from Owrbit

Subscribe to get the latest posts sent to your email.